By Nancy Pereira, Employee Benefits Advisor

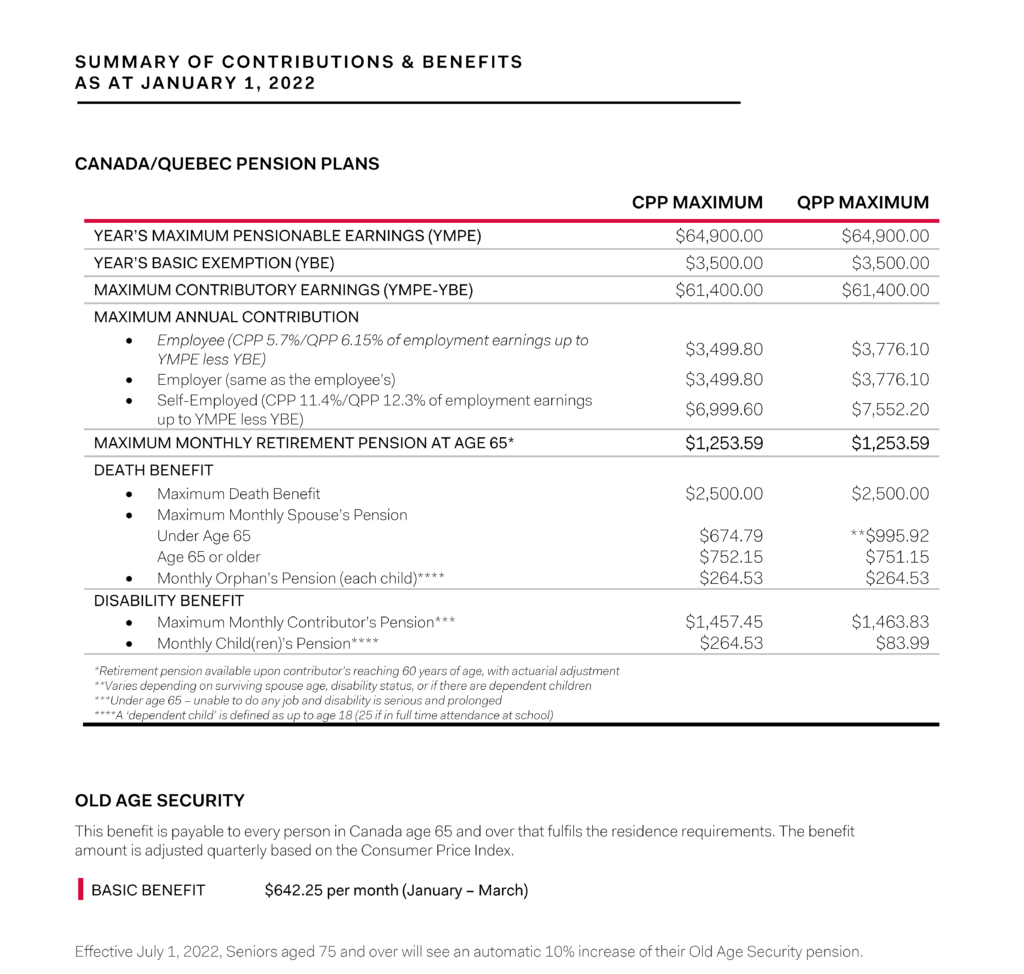

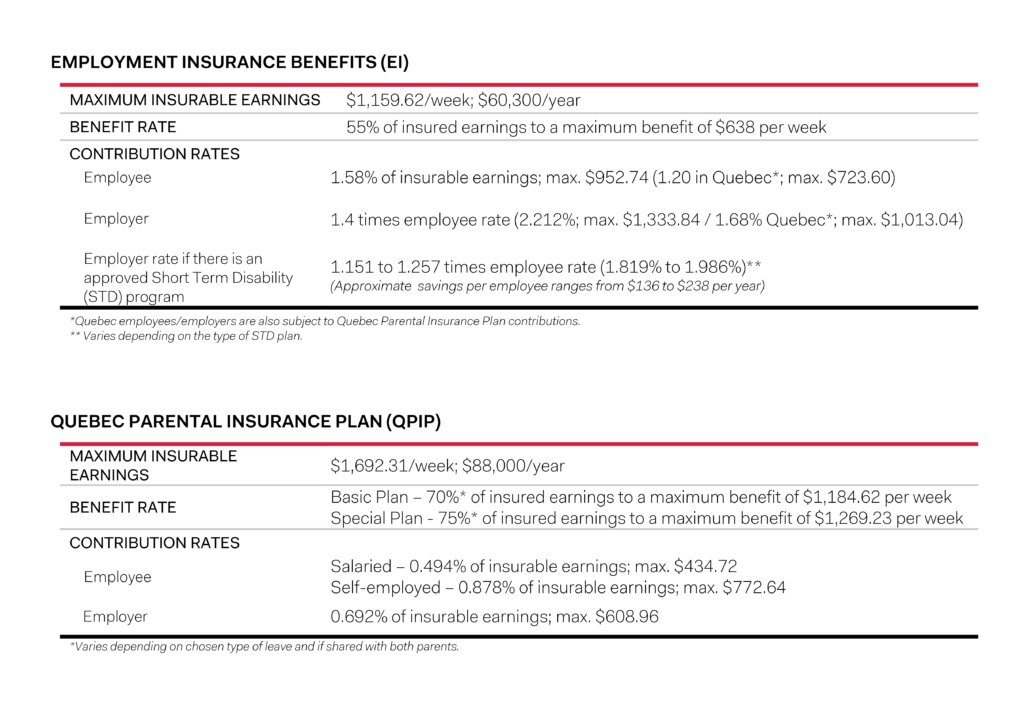

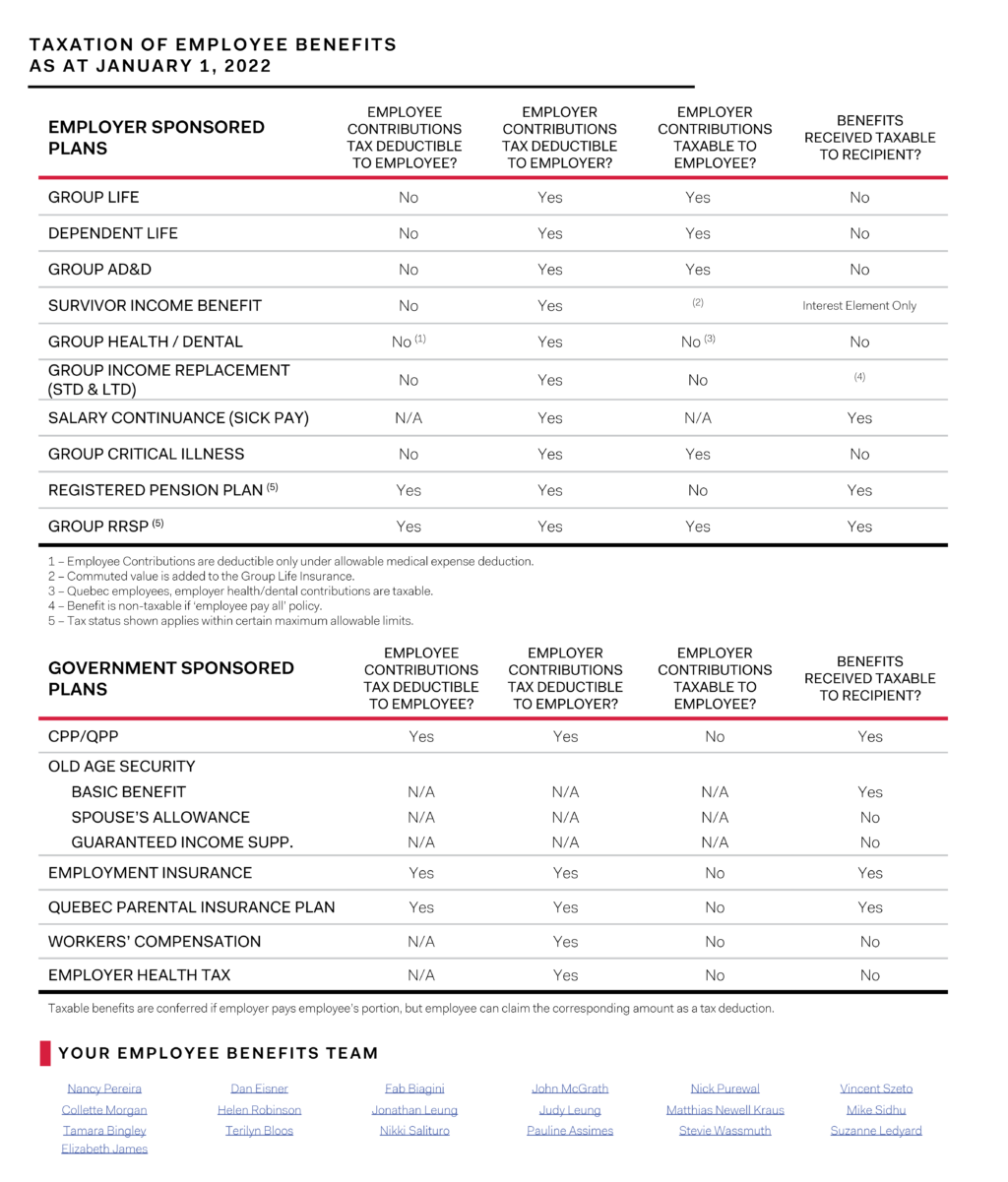

Attached please find ZLC Financial’s annual Summary of Contributions publication related to Canadian statutory programs and the taxation of employee benefits. This summary has been designed to serve as a quick reference guide for your convenience. If you have any questions on the information provided, please do not hesitate to contact a member of our Employee Benefits Team.

This information is designed to educate and inform you of strategies and products currently available. As each individual’s circumstances differ, it is important to review the suitability of these concepts for your particular needs with a qualified advisor. Source: Government of Canada Website and Government of Québec Website.